Property Description

The Bleiberg Zinc-Germanium-Lead-Fluorite-Cadmium Mine Complex, is considered a world class deposit and consists of 116 exploration licenses totaling 6,582.4 hectares, located approximately 130 kilometers south of the city of Salzburg, Austria. Bleiberg is a well-known, 700 year old, polymetallic zinc, germanium, lead, fluorite and cadmium mine site with first operations more than 2,000 years ago with numerous scientific publications, extensive infrastructure and known mineralized bodies.

Geology

The Bleiberg property is one of four major Mississippi valley type lead zinc camps associated with the Periadriatic Lineament, a regional suture stretching from Italy through Austria and Slovenia to Romania. These deposits are part of an east-west mineralized belt that is approximately 1200 km in length.

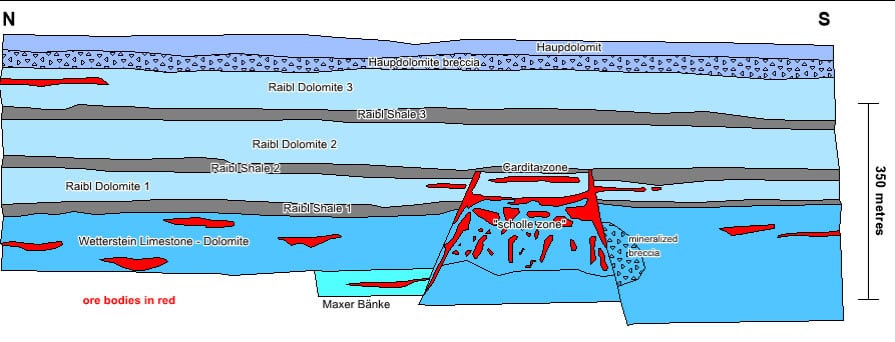

1.5 kmThe Bleiberg deposits are hosted in approximately 15 kilometers of Triassic lagoonal sediments. In the area these consist of the Wetterstein Formation, a dolomitic carbonate platform and the overlying Raibl Group, an alternating sequence of three 10 to 40-meter-thick terrigenous clastic and 30 to 70 meter thick carbonate evaporate units. Mineralization is largely confined to the upper 60 meters of the 300 meter thick Wetterstein Formation and the first or lowermost carbonate evaporate unit in the overlying Raibl Group. Mineralization consists of classic stratabound mineralization in the upper 60 meters of the Wetterstein; the Kalkscholle, Josefischolle, Riedhardscholle breccia bodies also in the upper Wetterstien; and strata bound mineralization in the overlying Raibl Formation.

History

The mine was among the top six (6) largest Germanium producers in the world. Germanium is widely used in the electronic semiconductor industry.

Recoverable long-term approx. average grades were: Zinc 5 to 6%, Lead 1%, Germanium 200 ppm, Cadmium 0.2%, Fluorite (Fluorspar) 10%. Based on the total production and including by-products Germanium and Cadmium the average recovered value of the historic production is $550 per wet metric tonne mined using current pricing of $2.68/Kg Zinc, 1.9 /Kg lead, $1,865 per kilogram Germanium and $2.54/lb Cadmium. In addition, the deposit contains Fluorite which has a current price of $450/metric tonne.

The Bleiberg property was acquired as part of an 1867 consolidation of six large and eighty small mines by Bleiberger Bergwerksunion. This company was subsequently nationalized in 1946 and operated until 1993 when it finally closed due to a combination of low metal prices and the bankruptcy of the state-owned conglomerate that included Bleiberger Bergwerksunion.

The Bleiberg mine was in production from the 1333 until its shutdown in 1993. Production up to 1951 was concentrated on the metal-rich strata bound mineralization of the uppermost Wetterstein Formation. Approximately 3 million tons of zinc and lead metal were produced at an average grade of 1% Pb and 5% Zn. Mineralization consisted of sphalerite, galena and pyrite in oval-shaped ore bodies subparallel to the bedding and also within discordant fissures and veins. (Zeeh and Bechstadt, 1994).

After 1951, production shifted to the western section of the mine to develop and mine the Kalkscholle, a stock-shaped mineralized body of about 2 million cubic meters. Within this body, the zinc rich mineralization occurs as networks and within breccias, and in some areas as coarse masses of sphalerite. The average grade was 0.5% Pb and 4.5% Zn. Two additional mineralized bodies, JosefischoIle and Riedhartscholle were subsequently discovered. The average grade of the 3 bodies is 6% combined Pb and Zn with Zn/Pb ratios of 6:1 to 10:1, suggesting the three bodies contained a combined 8 million tonnes of metal. The amount of material mined and remaining was not disclosed. (Zeeh and Bechstadt, 1994).

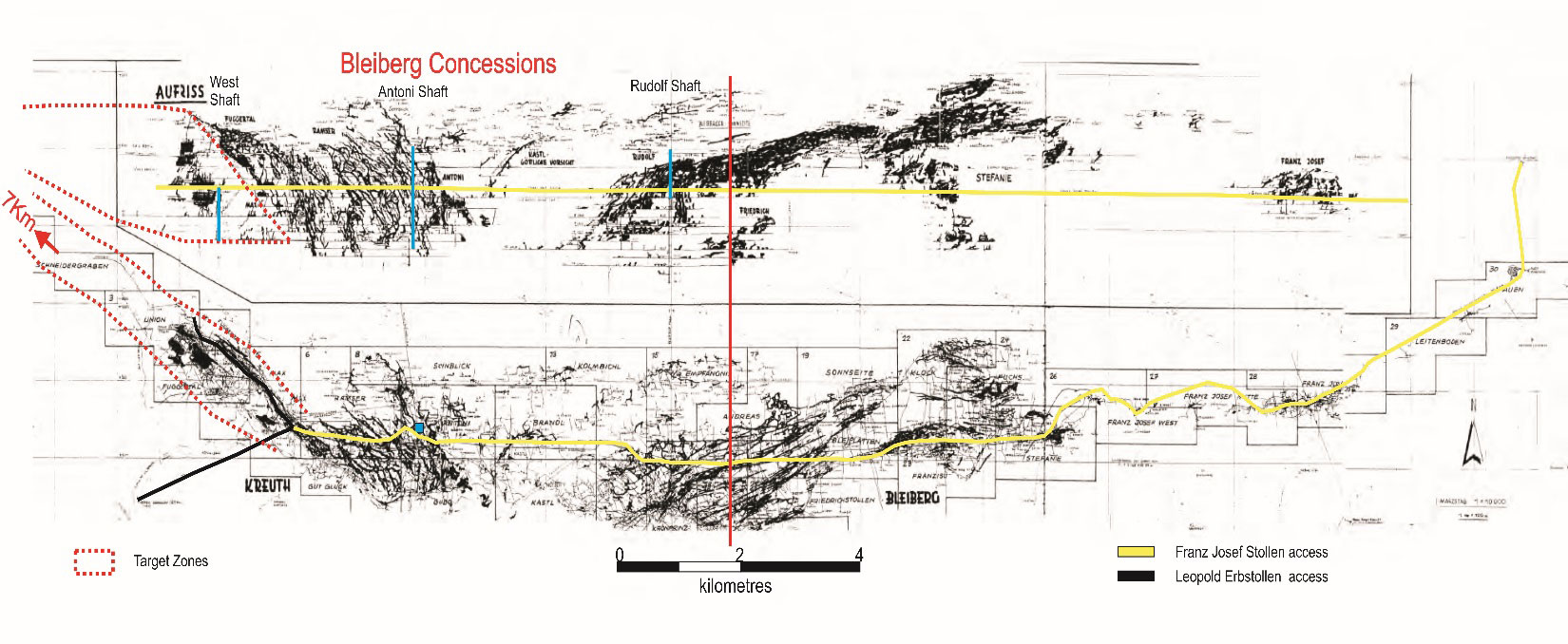

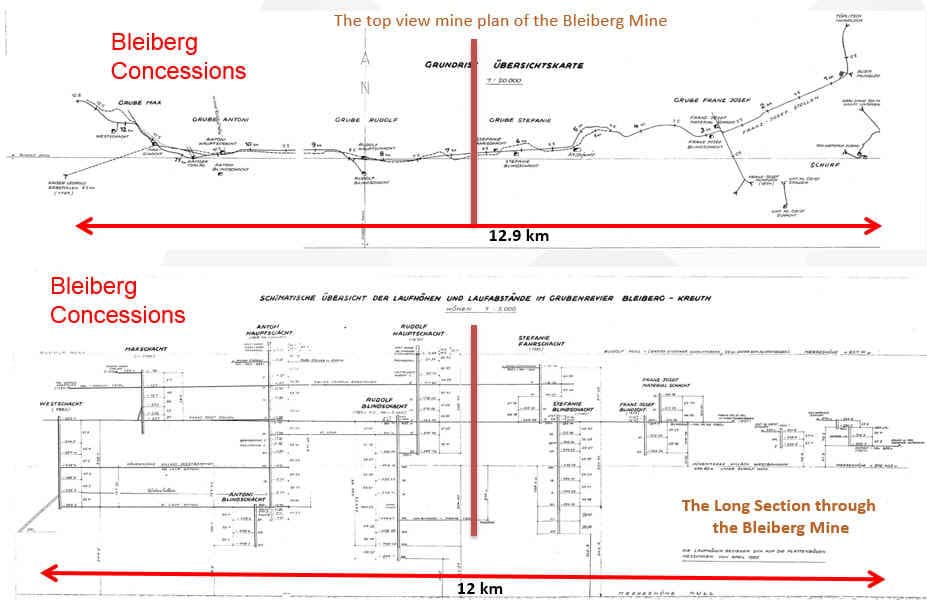

Approx. 1150 km of existing tunnels and several mine shafts, plus other infrastructures were constructed throughout its history.

Targets

Note: The targets and the potential quantity and grade are conceptual in nature as there had been insufficient exploration work done to define Mineral Resources as defined by NI 43-101, and it is uncertain if further exploration would result in establishing the existence of Mineral Resources.

Numerous authors and researchers from a wide range of university bodies suggest a geological target in the order of 13 to 50 million tonnes at historic grades of : Zinc 5 to 7%, Lead 0.5 to 1.5%, Germanium 150 to 250 ppm, Cadmium 0.15% to 0.25%, Fluorite (Fluorspar) 8 to 12%.

The Eastern part of the structure by general consensus has been mined out to a 900 meters depth and currently also is under water. The western part is accessible without dewatering through the Leopold Erbstollen access adit.

Main target consists of new zones in the hanging wall of known structures and already identified new zones in the western section of the property and their westerly extensions. A total of approximately 8 kilometers of strike and 1.5 kilometers in width remain to be explored and developed.

The Company intends to initially determine what was previously identified in the 1991 to 1993 drilling and what had already been scheduled for mining beyond the shutdown date in 1993.

In addition to targeting the larger mineral deposits, the Company plans to investigate upgrading of mineralization using ore sorting to allow for the recovery of narrower high-grade veins /stockworks that were left by previous miners. The strong visual contrast between the waste rock and mineralization makes the material ideal for sorting.

Permitting and Environmental

All exploration and development will be done underground from existing water-free access tunnels. The current plan would be to locate any future production facilities, tailings and waste deposits underground resulting in little to no effect on the surface making for easier permitting process. The main rock type is limestone that completely neutralizes any acid generating sulphides. It should be noted that water in the eastern portion of the mine complex is used to generate hydroelectricity and the clean water is discharged directly to the environment indicating no problems with water quality.

There are several waste dumps in the area that are the responsibility of the Austrian Government. The Company plans to investigate the possibility of recovering fluorite and other metals from these waste dumps and removing them back underground as a joint work program with the Austrian Government.

October 26, 2022 MultiMet announced the signing of a joint venture agreement for the development of the Bleiberg Project, with Battery Age Metals (formerly Pathfinder Resources Ltd.) an Australian public company.

Under the terms of the agreement, Battery Age can earn an 80% interest in the Bleiberg Project by making payments of Cdn$75,000, ands $Cdn554,500 in shares, spending a total of Cdn$4.5 million and deliver a bankable feasibility with a minimum production rate of 200 tonnes per day, at no cost to MultiMet. The deal covers up to 6 years and is divided in four (4) stages.

Stage 1 involves the payment of Cdn$75,000 in cash and Cdn$177,000 in shares. a Cdn$25,000 has already been made to give Battery Age 3-month exclusivity and the remaining cdn$50,000 and shares are to be paid within 5 days of MultiMet receiving an extension to the Bleiberg concessions and Battery Age receiving shareholder approval at their meeting November 30, 2022. The extension of the Bleiberg concessions, until December 31, 2026, has already been received from the Austrian Mining Ministry . The number of shares is to be determined by the greater of: (A) the 10-day volume weighted average price of Shares; and (B) A$0.40. Upon making the payments Battery Age would have earned a 15% interest in the property.

Stage 2 comprises earning an additional 36% interest in the project by incurring a minimum of Cdn$1,000,000 of Joint venture expenditures and issuing Cdn$377,500 worth of shares calculated based on the greater of: (A) the 10-day volume weighted average price of Shares; and (B) A$0.40. Stage 2 is to be completed within 24 months of the completion of stage 1

Stage 3 consist of earning an additional 15% interest in the project by incurring a minimum of Cdn$3,500,000 of Joint venture expenditures. Stage 3 is to be completed within 24 months of the completion of stage 2

Stage 4 involves delivering a bankable feasibility study with a minimum 200 tons per day production rate to earn a final 15% interest in the project to bring Battery Age interest to 80%.

On January 31, 2023 MultiMet received the first paymnent under terms of the agreement.

Sources:

Cerny,I. (1991). Lagerstättenforschung in Kärnten Neuergebnisse und Aspekte für die Zukunft. Carinthiall 181./101. Jahrgang S. 119-129 Klagenfurt 1991

Cerny,I. and Schroll,E. (1995). Spezialmetallgehalte in ZnS-Konzentraten der Lagerstätte Bleiberg-Kreuth. Arch. f. Lagerst.forsch. Geol. B.-A. ISSN 0253-097X Band 18 S. 5–33 Wien, Juni 1995

Schroll,e. (2006). Neues zur Genese der Blei-Zink Lagerstätte Bleiberg. Carinthia II 196./116. Jahrgang Seiten 483-500 Klagenfurt 2006